Mordor Intelligence has published a new report on the Bond Market, offering a comprehensive analysis of trends, growth drivers, and future projections.

Introduction to the Bond Market

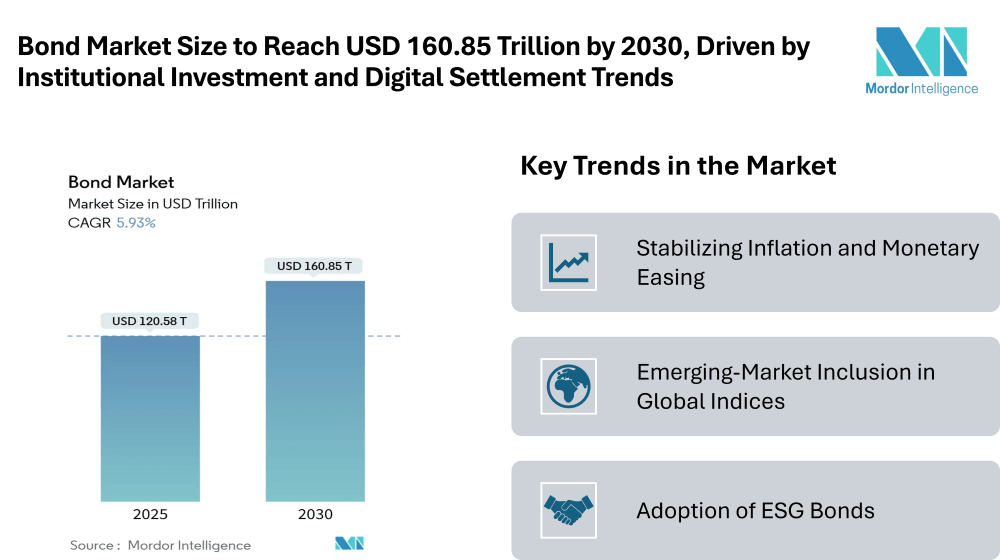

The bond market stood at a current value of USD 120.58 trillion in 2025 and is forecast to reach USD 160.85 trillion by 2030, reflecting a 5.93% CAGR. This growth highlights the increasing importance of bonds in global financial portfolios, with North America holding the largest Bond Market share and Asia-Pacific emerging as the fastest-growing region.

The Bond Market growth is supported by its critical role in financing governments and corporations, providing investors with stable returns and serving as a benchmark for credit pricing. Rising high-yield issuance, strategic investment allocation, and operational advancements within the Bond industry are further driving the Bond Market growth, ensuring sustained demand and opportunities across regions and sectors.

Key Trends Shaping the Bond Market

- Stabilizing Inflation and Monetary Easing: Central banks have initiated easing cycles after a period of high inflation. Lower policy rates make bonds more attractive, particularly intermediate and long-dated securities that offer predictable income streams.

- Institutional Rebalancing: Pension funds and insurers are increasingly aligning portfolios with long-term liabilities. By investing in longer-tenor bonds, institutions reduce risk while securing stable returns. This shift is reinforcing liquidity and demand in the Bond Market.

- Emerging-Market Inclusion in Global Indices: Countries like India, Indonesia, and Vietnam are being included in global bond indices, channeling significant passive inflows and improving liquidity. These developments are broadening market access and enhancing the attractiveness of local-currency bonds.

- Adoption of ESG Bonds: Environmental, Social, and Governance (ESG) bonds are gaining traction, particularly in Europe, as investors seek sustainable investment opportunities. Green bonds constitute a substantial portion of sustainable bond issuance, contributing to diversified investment options within the Bond industry.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/bond-market?utm_source=emailwire

Market Segmentation of the Global Bond Industry

- By Type:

Treasury Bonds

Municipal Bonds

Corporate Bonds

- By Issuer:

Public Sector

Private Sector

- By Sector:

Energy & Utilities

Technology, Media & Telecom

Healthcare & Pharmaceuticals

- By Geography:

North America

Europe

Asia-Pacific

Explore Our Full Library of Financial Services and Investment Intelligence Research Reports – https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=emailwire

Key Players in the Global Bond Market

- Microsoft Corporation – A leading global technology company issuing corporate bonds to finance operations, acquisitions, and technology investments.

- AT&T Inc. – A major telecommunications provider in the U.S., issuing bonds to fund network expansion and capital expenditures.

- Verizon Communications – A top U.S. telecom company leveraging bond issuance for infrastructure development and service enhancements.

- United States Treasury (sovereign) – The U.S. government issues Treasury bonds as a primary instrument for financing public debt.

- Government of Japan – Japan’s sovereign issuer of government bonds to fund fiscal programs and manage national debt.

Conclusion

The Bond industry is poised for continued expansion, driven by institutional investment strategies, technological integration, and evolving regional participation. As market participants adapt to trends such as ESG adoption, digital settlement, and emerging-market inclusion, the global Bond industry will continue to serve as a cornerstone of financial systems.

The evolving dynamics of the Bond Market emphasize its critical role in providing liquidity, income stability, and capital formation. Investors and issuers alike are navigating these changes to maximize returns, reduce risks, and access new opportunities across regions and sectors.

For complete market analysis, please visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/bond-market?utm_source=emailwire

Industry Related Reports

The Corporate Bond Market report segments the industry into By Type Of Bonds (Investment-Grade Corporate Bond Funds, High-Yield Corporate Bond Funds, Sector-Specific Corporate Bond Funds), By Investor Type (Institutional Investors, Retail Investors), and By Geography (North America, Europe, Asia Pacific, South America, Middle East). Get historical data covering five years and forecasts for the next five years.

The Global Green Bonds Market is Segmented by Issuer Type (Sovereigns, Supranationals & Agencies, Financial Corporates, Non-Financial Corporates, and Municipal & Local Authorities), Use-Of-Proceeds Sector (Energy, Buildings, Transport, Water & Wastewater, and More), Bond Format (Senior Unsecured, Asset-backed/Project Bond, Covered Bond, and More), and Geography.

US Fixed Income Asset Management Industry

The Report Covers US Fixed Income Asset Management Companies and the Market is Segmented Based On the Client Type (Retail, Pension Funds, Insurance Companies, Banks, and Other Client Types), and by Asset Class (Bonds, Money Market Instruments (includes Mutual Funds), ETF, and Other Asset Classes)

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana – 500032, India.