Introduction

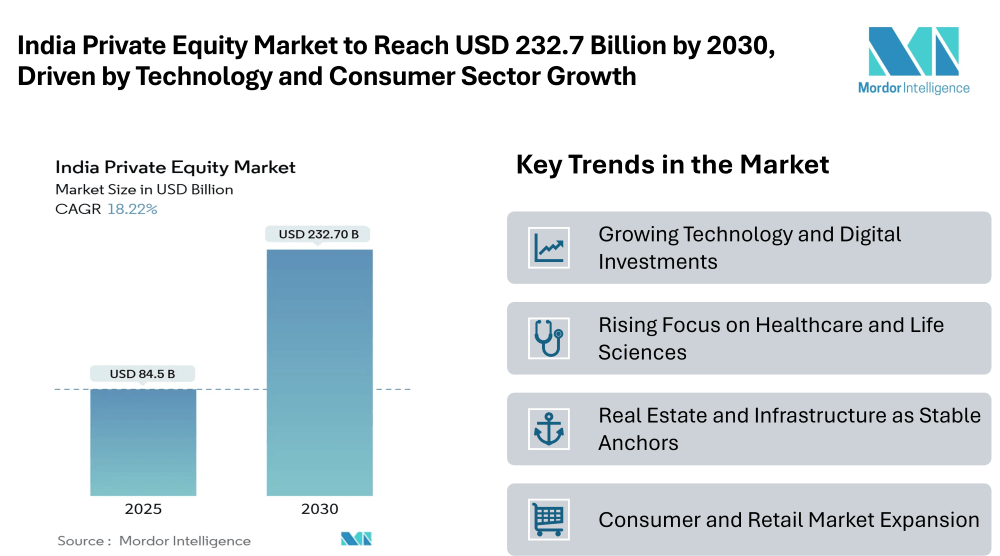

The India private equity market stands at USD 84.5 billion in 2025 and is on track to swell to USD 232.7 billion by 2030, compounding at 18.22% CAGR annually. This expansion reflects the growing role of private equity as a key driver of capital formation, entrepreneurship, and sectoral modernization in the country. Increasing participation from global and domestic investors, combined with favorable demographics and an expanding middle class, has strengthened India’s position as one of the fastest-growing destinations for private equity inflows.

Private equity has become an important financing alternative, complementing traditional bank lending and public markets. From technology and healthcare to consumer and infrastructure, investment activity spans multiple industries that benefit from both capital and strategic support offered by funds. India’s private equity market growth trajectory highlights the rising confidence in India’s long-term growth outlook and the structural reforms that continue to enhance the investment climate.

Key Trends Shaping the India Private Equity Market

Growing Technology and Digital Investments

The technology sector continues to dominate private equity flows in India. With the country’s rapidly growing digital economy, investors are channeling funds into fintech, SaaS platforms, and digital-first consumer services. The surge in online retail, payments, and cloud adoption is making technology an attractive bet for both domestic and global funds.

Rising Focus on Healthcare and Life Sciences

Healthcare and life sciences are increasingly attractive for private equity due to rising healthcare demand, expanding insurance penetration, and the growth of pharmaceutical exports. Investors are targeting diagnostics chains, hospital networks, and biotech firms that are scaling quickly to meet both domestic and global needs.

Real Estate and Infrastructure as Stable Anchors

Private equity funds are active in India’s real estate and infrastructure markets, particularly in commercial real estate, logistics, and data centers. These investments are supported by regulatory reforms and the rising need for modern infrastructure to sustain economic growth. Long-term opportunities in industrial and warehousing segments remain strong.

Consumer and Retail Market Expansion

India’s consumption-driven economy offers consistent opportunities for private equity investment. Retail chains, food and beverage brands, and digital-first consumer companies have been receiving strong backing, reflecting confidence in the country’s growing middle class and urbanization.

Financial Services and Fintech Growth

Private equity investors continue to show interest in financial services, particularly fintech startups that cater to credit, payments, and wealth management. The sector benefits from high adoption of digital financial solutions and government support for financial inclusion.

Increasing Participation from Global Investors

The India private equity market is witnessing higher levels of investment from large global funds. Global firms are setting up dedicated India-focused strategies, often in collaboration with domestic partners, to capture growth across sectors. This trend is expected to deepen with India’s sustained economic growth.

Check out more details and stay updated with the latest industry trends, including the Japanese version for localized insights: https://www.mordorintelligence.com/ja/industry-reports/india-private-equity-market-growth-trends-and-forecast-2020-2025?utm_source=emailwire

India Private Equity Market Segmentation

The India Private Equity Market is segmented by fund type, sector, investment size, and region. This segmentation also provides insight into the india private equity market size, helping investors identify opportunities across stages and industries.

By Fund Type

- Mezzanine and Distressed

By Sector

By Investments

By Region

- East and Northeast India

This segmentation reflects the market’s diverse opportunities, with funds active across growth-stage startups, mature enterprises, and distressed assets. Regional segmentation further illustrates how investment flows align with India’s diverse economic hubs.

Explore Our Full Library of Financial Services and Investment Intelligence Research Industry Reports: https://www.mordorintelligence.com/market-analysis/financial-services-and-investment-intelligence?utm_source=emailwire

Key Players in the India Private Equity Market

The market includes a mix of domestic players and global giants. Leading participants include:

- Chrys Capital – One of India’s largest homegrown private equity firms with a strong focus on financial services, healthcare, and consumer sectors.

- Sequoia Capital – A leading venture capital firm that has invested in many of India’s most prominent startups across technology and consumer markets.

- Blackstone Group – A global private equity leader with a strong presence in Indian real estate, infrastructure, and financial services.

- Advent International – Known for investments in healthcare, consumer goods, and industrial companies, Advent has been increasingly active in India.

- KKR – A global powerhouse with investments spanning infrastructure, real estate, technology, and consumer-facing companies in India.

These players bring not only capital but also strategic expertise, helping portfolio companies scale and integrate with global markets. The competitive landscape, as highlighted in the india private equity market report, reflects the growing maturity of India’s private equity ecosystem, where both domestic and international funds are building deep portfolios.

Explore more insights on India private equity market competitive landscape: https://www.mordorintelligence.com/industry-reports/india-private-equity-market-growth-trends-and-forecast-2020-2025/companies?utm_source=emailwire

Conclusion

The India private equity market is positioned for significant growth, driven by strong economic fundamentals, a large pool of entrepreneurial talent, and sectoral opportunities across technology, healthcare, consumer, and infrastructure. Global investors are increasingly drawn to India’s diverse economy, while domestic funds continue to scale up their activity and expertise.

As structural reforms, digital transformation, and rising consumption reshape the investment landscape, private equity will play a central role in providing growth capital, enhancing corporate governance, and enabling innovation across industries. The outlook suggests continued expansion of opportunities, with the sector maturing into a crucial pillar of India’s economic growth story. The india private equity market share is expected to expand further as the country cements its position as a global investment hub.

For complete market analysis, please visit the Mordor Intelligence page: https://www.mordorintelligence.com/industry-reports/india-private-equity-market-growth-trends-and-forecast-2020-2025?utm_source=emailwire

Industry Related Reports

US Private Equity Market: United States Private Equity Market is Segmented by Fund Type (Buyout Fund, Growth Equity Funds, and More), Sector (Technology, Healthcare, Consumer and Retail and More), Deal Size ( Small Cap, Mid Cap, Large Cap and Mega Deals), Investor Type (Pension Fund, Investment Company, Funds of Funds, Family Offices and More), Exit Strategy (Trade Sale, IPO and More), and Region.

Get more insights: https://www.mordorintelligence.com/industry-reports/united-states-private-equity-market?utm_source=emailwire

Global Private Equity Market: The Global Private Equity Market is Segmented by Fund Type (Buyout and Growth, Venture Capital, Mezzanine, and More), Sector (Technology, Healthcare, Real Estate, Financial Services, Industrials, Telecom, and More), Investments (Large Cap, Upper-Middle Market, and More), and Region (Europe, North America, South America, Asia-Pacific, and Middle East and Africa).

Get more insights: https://www.mordorintelligence.com/industry-reports/global-private-equity-market?utm_source=emailwire

Europe Private Equity Market: The Europe Private Equity Market is Segmented by Fund Type (Buyout and Growth, Venture Capital, Mezzanine, and More), Sector (Technology, Healthcare, Real Estate, Financial Services, Industrials, Telecom, and More), Investments (Large Cap, Upper-Middle Market, and More), and Country (United Kingdom, Germany, France, Sweden, Italy, Spain, Netherlands and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/europe-private-equity-market?utm_source=emailwire

Asia-Pacific Private Equity Market: The Asia-Pacific Private Equity Market is Segmented by Fund Type (Buyout and Growth, Venture Capital, Mezzanine, and More), Sector (Technology, Healthcare, Real Estate, Financial Services, Industrials, Telecom, and More), Investments (Large Cap, Upper-Middle Market, and More), and Country (India, China, Japan, Australia, South Korea and More).

Get more insights: https://www.mordorintelligence.com/industry-reports/asia-pacific-private-equity-market?utm_source=emailwire

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana – 500032, India.